43 turbotax home and business 2017 best price

Techmeme Nov 20, 2022 · Court documents: FTX owes $3.1B to its 50 biggest unsecured creditors, with claims ranging from $21M to $226M; ten claims are over $100M each — Sam Bankman-Fried's bankrupt crypto empire owes its 50 biggest unsecured creditors a total of $3.1 billion, new court papers show, with a pair of customers owed more than $200 million each. Taking Business Tax Deductions - TurboTax Tax Tips & Videos Web18.10.2022 · If you have a home office, a drive from your home to a supplier and back home again is a 100% deductible business expense. When figuring expenses, you may choose between taking the standard mileage rate (which generally changes every six months to a year), or deducting your actual expenses for items such as gas, oil changes, …

Buying Your First Home - TurboTax Tax Tips & Videos Web18.10.2022 · You can't deduct these expenses now, but when you sell your home the cost of the improvements is added to the purchase price of your home to determine the cost basis in your home for tax purposes. Although most home-sale profit is now tax-free, it's possible for the IRS to tax you on the profit when you sell. Keeping track of your basis will help …

Turbotax home and business 2017 best price

The Home Office Deduction - TurboTax Tax Tips & Videos Oct 18, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ... Quicken Personal Finance & Money Management Software †Discounts are calculated based on the annual price. The final price may differ from the monthly discounted price multiplied by 12 months. All offers are for the first year only when you order directly from Quicken by November 29, 2022, 11:59 PM PT. Offer good for new memberships only. Subscription billed annually. Tax Tips After January 1, 2023 - TurboTax Tax Tips & Videos Web17.11.2022 · You are entitled to write off expenses that are associated with the portion of your home where you exclusively conduct business (such as rent, utilities, insurance and housekeeping). The percentage of these costs that is deductible is based on the square footage of the office to the total area of the house. A middle-class taxpayer who uses a …

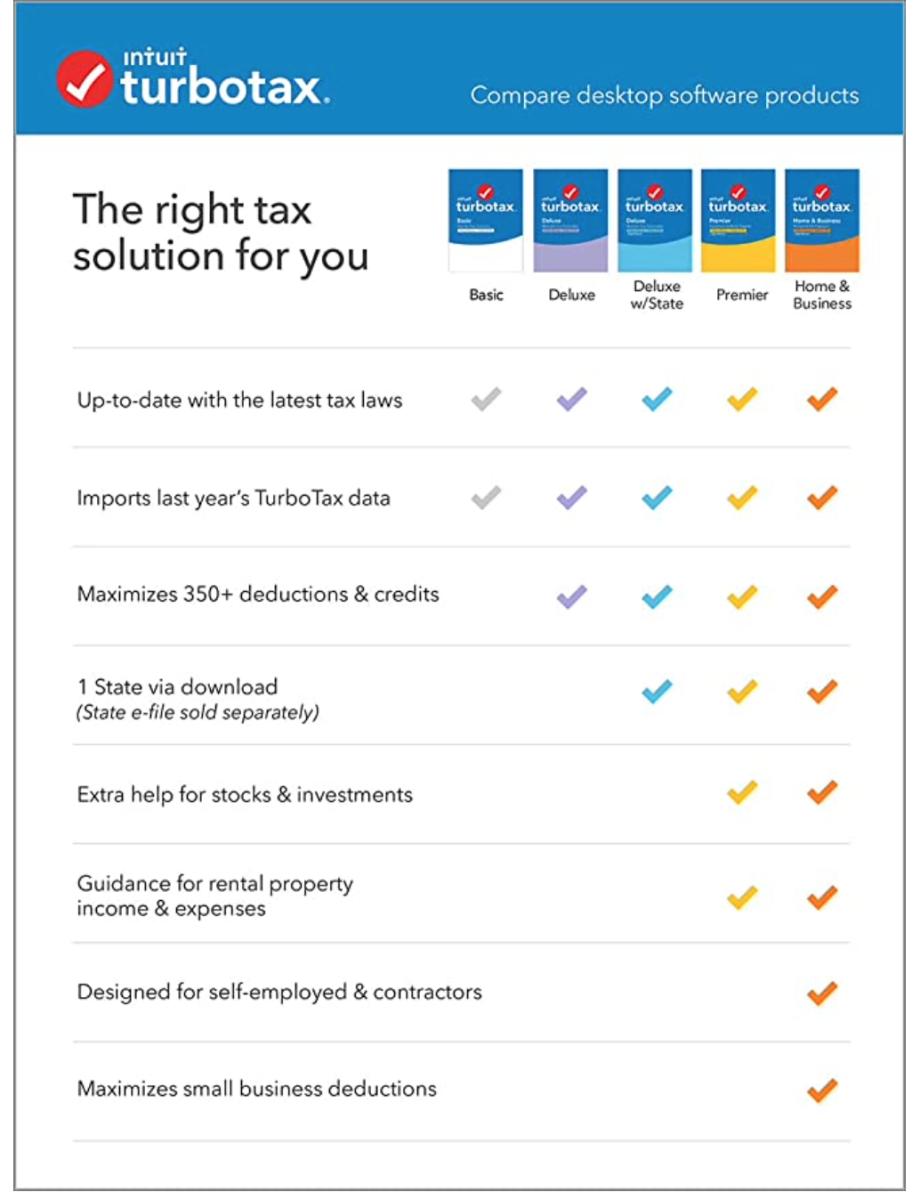

Turbotax home and business 2017 best price. TurboTax Live® | Talk to Real Tax Experts Online WebI own a home. I have children or dependents. I want a tax expert to review my return . I donated over $300 to charity. I'm paying off student loans. I sold stock, crypto, or own rental property. I'm self-employed/an independent contractor. Am I self-employed? I own a small business. You can do it. Real experts help or do it for you. Real experts to help—or even … Home Improvements and Your Taxes - TurboTax Tax Tips & Videos Web18.10.2022 · If you operate a business from your home or rent a portion of your ... If filed after March 31, 2023 you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here. Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses … TurboTax® Official Site: File Taxes Online, Tax Filing Made Easy Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ... W-4 Calculator 2022 - TurboTax TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change without notice.

TurboTax Desktop Software End User License Agreement Tax … WebTurboTax Online Business Products-For TurboTax Live Assisted Business and TurboTax Full Service Business we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits , Entities electing to be treated as a C-Corp, Schedule C Sole … Tax Tips After January 1, 2023 - TurboTax Tax Tips & Videos Web17.11.2022 · You are entitled to write off expenses that are associated with the portion of your home where you exclusively conduct business (such as rent, utilities, insurance and housekeeping). The percentage of these costs that is deductible is based on the square footage of the office to the total area of the house. A middle-class taxpayer who uses a … Quicken Personal Finance & Money Management Software †Discounts are calculated based on the annual price. The final price may differ from the monthly discounted price multiplied by 12 months. All offers are for the first year only when you order directly from Quicken by November 29, 2022, 11:59 PM PT. Offer good for new memberships only. Subscription billed annually. The Home Office Deduction - TurboTax Tax Tips & Videos Oct 18, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ...

![TurboTax 2019 Home & Business Software CD [PC and Mac] [Old Version]](https://m.media-amazon.com/images/I/41kqalhswML._AC_SY780_.jpg)

![TurboTax Home & Business 2021 Tax Software, Federal and State Tax Return w/Federal E-file [Amazon Exclusive] [PC/Mac Disc]](https://m.media-amazon.com/images/I/51K49wmtrcL._AC_SY780_.jpg)

0 Response to "43 turbotax home and business 2017 best price"

Post a Comment